How Matthew J. Previte Cpa Pc can Save You Time, Stress, and Money.

Matthew J. Previte Cpa Pc - Questions

Table of ContentsSome Known Questions About Matthew J. Previte Cpa Pc.10 Simple Techniques For Matthew J. Previte Cpa Pc9 Easy Facts About Matthew J. Previte Cpa Pc ShownSome Ideas on Matthew J. Previte Cpa Pc You Should KnowExamine This Report about Matthew J. Previte Cpa PcSome Known Facts About Matthew J. Previte Cpa Pc.

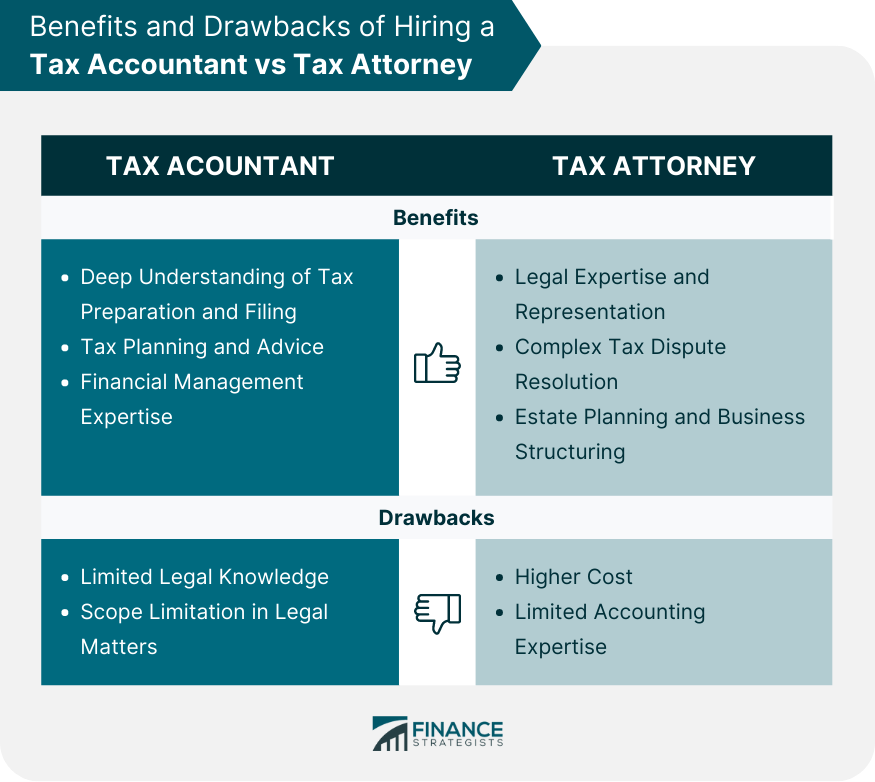

Also in the simplest monetary circumstance, filing state and/or government tax obligations can be a daunting annual task. When it concerns browsing intricate tax obligation problems, however, this complex procedure can be downright intimidating to deal with by yourself. No matter your revenue, reductions, household demographics, or profession, working with a tax obligation lawyer can be helpful.Plus, a tax attorney can chat to the Internal revenue service on your part, saving you time, energy, and irritation. A tax obligation attorney is a type of legal representative that specializes in tax regulations and treatments.

The Best Guide To Matthew J. Previte Cpa Pc

If you can not satisfy that financial obligation in time, you might even face criminal charges. Consequently, outstanding tax obligation debt is an excellent reason to work with a tax relief attorney. The right tax lawyer can not just connect with the IRS on your behalf but also represent you in working out a worked out financial debt balance (an Deal in Concession) with the internal revenue service for less than you currently owe.

A tax attorney can additionally represent you if you select to combat the IRS or aid produce a technique for paying off or settling the shortage - IRS Collection Appeals in Framingham, Massachusetts. A tax obligation attorney can supply support, help you establish exactly how much your organization can expect to pay in tax obligations, and encourage you of strategies for minimizing your tax problem, which can help you prevent costly errors and unexpected tax obligation costs while taking advantage of particular policies and tax obligation rules.

Selecting a tax lawyer must be done meticulously. Here are some ways to increase your possibilities of locating the best individual for the work: Prior to working with a tax obligation lawyer, recognizing what you need that lawyer to do is crucial.

The Buzz on Matthew J. Previte Cpa Pc

Some tax obligation relief companies supply plans that offer tax obligation services at a flat rate. Various other tax obligation attorneys may bill by the hour.

With tax obligation attorneys that bill per hour, you can anticipate to pay in between $200 and $400 per hour generally - https://www.brownbook.net/business/52576139/matthew-j-previte-cpa-pc/. Your final cost will certainly be identified by the complexity of your circumstance, just how promptly it is reduced, and whether ongoing services are necessary. A standard tax obligation audit may run you around $2,000 on average, while finishing an Offer in Concession might set you back closer to $6,500.

The Matthew J. Previte Cpa Pc Ideas

The majority of the moment, taxpayers can deal with individual revenue tax obligations without way too much problem but there are times when a tax obligation lawyer can be either a handy resource or a needed partner. Both the internal revenue service and the California Franchise Business Tax Obligation Board (FTB) can obtain rather hostile when the guidelines are not adhered to, even when taxpayers are doing their ideal.

Both government companies provide the income tax obligation code; the internal revenue service takes care of government tax obligations and the Franchise business Tax obligation Board takes care of California state tax obligations. Unpaid Taxes in Framingham, Massachusetts. Since it has fewer sources, the FTB will certainly piggyback off results of an IRS audit but concentrate on areas where the margin of taxpayer error is higher: Purchases consisting of funding gains and losses 1031 exchanges Beyond that, the FTB tends to be extra hostile in its collection techniques

Getting The Matthew J. Previte Cpa Pc To Work

Your tax obligation attorney can not be asked to affirm against you in legal process. Neither a CPA neither a tax preparer can supply that exemption. The various other factor to employ a tax obligation attorney is to have the most effective guidance in making the right choices. A tax obligation attorney has the experience to accomplish a tax obligation settlement, not something the person on the street does daily.

A CPA may recognize with a few programs and, even after that, will certainly not necessarily understand all the provisions of each program. Tax obligation code and tax obligation laws are complicated and often transform yearly. If you remain in the internal revenue service or FTB collections process, the wrong recommendations can cost you a lot.

More About Matthew J. Previte Cpa Pc

A tax attorney can likewise assist you discover ways to reduce your tax costs in the future. If you owe over $100,000 to the IRS, your situation can be put in the Large Dollar Unit for collection. This unit has one of the most seasoned representatives helping it; they are hostile and they close situations quick.

If you have prospective criminal problems entering the investigation, you definitely want a legal representative. The internal revenue service is not recognized for being excessively responsive to taxpayers unless those taxpayers have cash to turn over. If the IRS or FTB are disregarding your letters, a tax lawyer can prepare a letter that will obtain their focus.